new haven auto taxes

New Haven Tax Collectors Office Contact Information. Our team consists of Tax Attorneys Tax Analysts ex- IRS Agents and Enrolled Agents.

Town Of Watertown Tax Bills Search Pay

The boot fee must be paid by money order or bank check only and made payable to Vioalert to have your vehicle released boots are usually released within 1 hour.

. Previously towns and cities could charge up to 45 in taxes per 1000 of assessed value or 45 mills according to General Assembly documents. Deliquient taxesInterest owed or assessment deferral agreements which are still being re. Please note that this calculator returns an approximate value and does NOT account for personal exceptions Elderly Disabled Veterans.

However you still must pay the entire amount due on the old vehicle. Home Inventory Financing Vehicle Finder Warranty About Us Contact Us Sitemap. New Haven Auto Sales.

03 - MOTOR VEHICLE 04 - MOTOR VEHICLE SUPP Disclaimer Terms And Conditions. All payments made after 8 pm Monday-Thursday allow 48 hours to be. Personal property and motor vehicle are computed in the same manner.

Address Phone Number Fax Number and Hours for New Haven Tax Collectors Office a Treasurer Tax Collector Office at Church Street New Haven CT. If you no longer own a motor vehicle listed on your tax bill you may provide proof of your claim to the Assessors Office. The online system which is.

928 Chapel St Ste 204. All payments made online before 8 pm Monday-Thursday are uploaded posted on the next business day holidays excluded. The DMVs Property Tax Section may be reached by by phone at 860 263-5153 or by mail at.

New Haven CT 06510 Office Hours Monday - Friday 900am - 500pm. City of New Haven. If you are booted you will need to pay your full tax delinquency to the City of West Haven Office of the Tax Collector and a separate boot fee of 150 to the Vioalert driver.

A serviceman having any questions in regard to motor vehicle property taxes or in need of an application to complete and file in sufficient time to meet filing dates to apply for such benefits should contact the local assessor. We accept cases Nationwide and offer many tax solutions. 1st Floor New Haven CT 06510.

Estimated Real Estate Property Tax Calculator. Under the new cap which was approved as part of the state budget last month lowered the amount each municipality can charge for taxes on motor vehicles. Name New Haven Tax Collectors Office Address 165 Church Street New Haven Connecticut 06510 Phone 203-946-8054 Fax 860-946-5561 Hours.

Owners of real personal and motor vehicle property are taxed at a rate of 1 on every 1000 assessed. Message Us 419-342-2886 3690 Park Ave West Mansfield OH 44903. Taxes-Consultants Representatives Tax Return Preparation Tax Reporting Service 203 823-9287.

Parks Public Works main number 203-946-8027 has temporarily changed to 203-946-6960. City Assessor Alex Pullen Email. Because your vehicle wasnt registered until January 2020 DMV will report your information to New Haven.

If you obtained new license plates for the new vehicle contact the Assessors Office at 203-946-4800. Phone 203 946-4800 Address 165 Church St. All other budgetary categories such as policefire health recreation transportation and watersewage treatment plants benefit from similar fiscal support.

The Connecticut Department of Motor Vehicles reports to townscities vehicles that are registered as of October 1st every year which are billed then every JulyJanuary. All information must be DATED and the MAKE MODEL VEHICLE IDENTIFICATION NUMBER must be on all documentation. Again real estate taxes are the largest way New Haven pays for them including more than half of all public school financing.

You will receive a credit on the supplemental bill for the amount you pay now on the old vehicle. NEW HAVEN City residents will now be able to pay their real estate and motor vehicle taxes online according to a press release by the city. New Haven Auto Sales has the best selection of used cars in Mansfield OH.

Tax Collector Email. Account info last updated on Jul 4 2022 0 Bills - 000 Total. Please contact the Tax Collectors office at 203-239-5321 x 620.

2020 Annual Report - Tax Office. View Cart Checkout. Payments made by personal checks in office or by mail will have an automatic five 5 business day hold unless you provide proof of payment before that time.

Name A - Z Sponsored Links. Taxes-Consultants Representatives Tax Return Preparation. Office Hours Monday - Friday 900 am.

Submit this documentation to the Assessors Office in person by fax or by mail to 250 Main Street East Haven CT 06512. Message Us 419-342-2886 3690 Park Ave West Mansfield OH 44903. Browse our online inventory to see what weve got on the lot or fill out our Vehicle Finder form to let us know what youre looking for.

Parks Public Works main number 203-946-8027 has temporarily changed to 203-946-6960. You will receive this credit without having to apply for it. DMV Property Tax Unit.

New Haven CT 06510. This is the email I received this morning from our tax collector. New Haven Auto Sales.

Home Shopping Cart Checkout. City Of New Haven. Motor Vehicle Tax in New Haven CT.

New Haven CT 06510. 165 Church St Ste 51. Therefore a real estate property assessed at.

If you received a tax bill for a vehicle not garaged in New Haven as of October 1 2021 contact the Assessors Office. Address 165 Church St. Per the FY 2022-2023 Mayors Proposed Budget.

A New Way To Curb The Rise Of Oversized Pickups And Suvs Bloomberg

Connecticut S Sales Tax On Cars

Thinking About Buying A Car Here S What Experts Say You Need To Know

Buying Cars Used Car Or New Car Which One Makes Economic Sense Post Pandemic

How To Gift A Car A Step By Step Guide To Making This Big Purchase

What To Know About U S Electric Car Tax Credits And Rebates Bloomberg

Norway Is Running Out Of Gas Guzzling Cars To Tax Wired

8 Steps To Buying A New Car Without Getting Ripped Off Hagerty Media

New Pink Tax Study Shows Women Pay Upwards Of 7 800 More For Car Ownership

Electric Vehicle Tax Credits What You Need To Know Edmunds

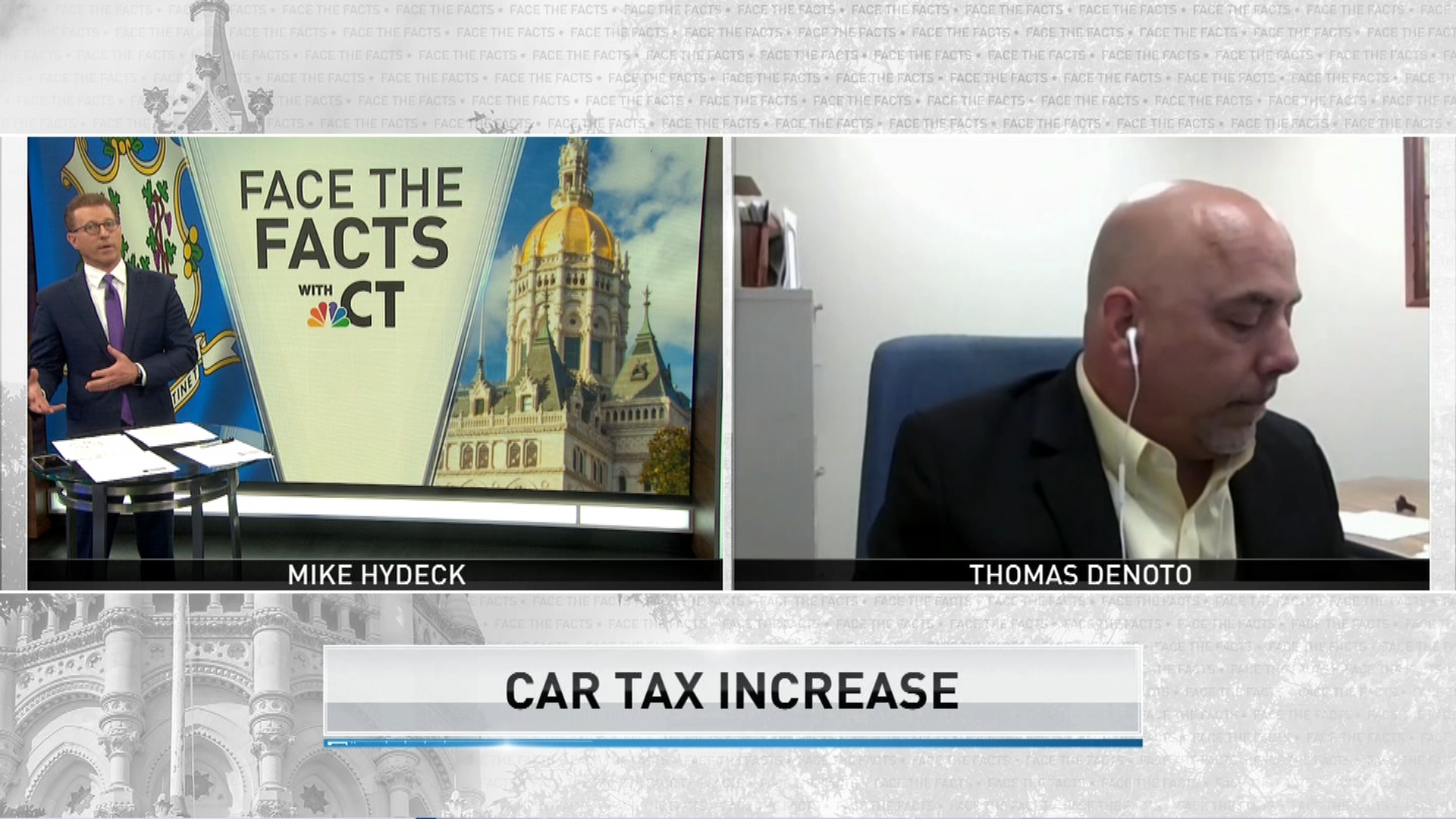

State Leaders Address Drivers Motor Vehicle Tax Bill Complaints Nbc Connecticut

/images/2022/02/08/woman_in_car.jpg)

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

/https://www.forbes.com/wheels/wp-content/uploads/2022/06/UsedEVMain.png)

10 Tips To Find And Buy Used Evs Forbes Wheels

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price